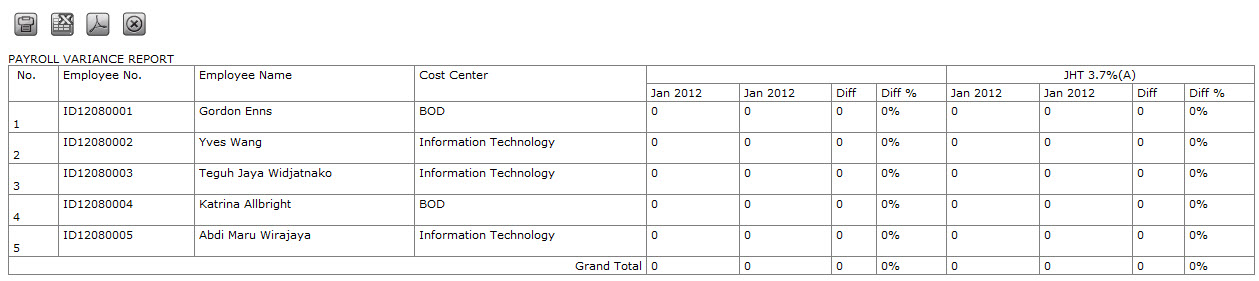

Payroll Variance Report

This report shows employee’s salary data comparison between two periods. The report shows differences in value between both periods (also shown in percentage). To access this page, go to Payroll > Payroll Report > Payroll Variance Report and the following page will appear.

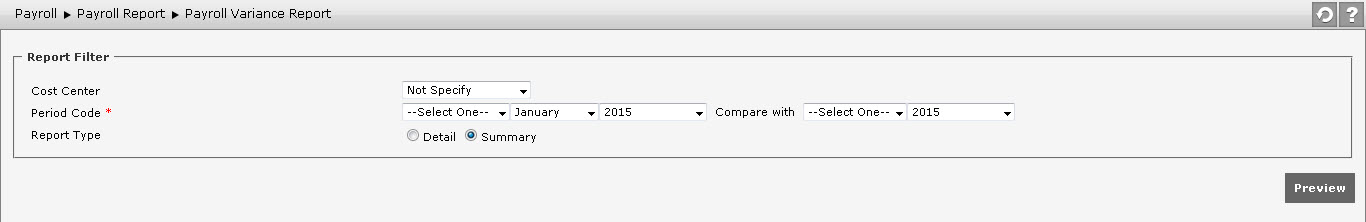

Determine the following information before creating the report.

- Cost Center: Choose the cost center. The default is “Any” (show all cost centers). The available option is configured in Cost Center Setting.

- Period: Determine the period. There are three options that must be completed: the payroll period, month, and year. Choosing more than one period is allowed. After the payroll period, choose the month and the year. The available payroll period options are configured in Payroll Period Setting.

- Payroll Component: Tick “All” to show all components. Un-tick it to select only one or a few. Choose the component then click

to move the selection to the right-side box. The selection is configured in Payroll Component.

to move the selection to the right-side box. The selection is configured in Payroll Component. - Displaying: Determine the type of display. The following types are: All, Currency Code, Default Value, Formula, Component Value, Taxed, Tax Class, Component Received, Effective Date, and End Date. Tick the type to be display type in the report.

- Sort By: Determine the sorting. You can choose to sort it whether by Employee Number, Employee Name, or Cost Center.

Click ![]() to preview the report.

to preview the report.